Additional deduction for purchase made within. This relief is applicable for Year Assessment 2013 and 2015 only.

Bmw X5 M Bmw X5 M Bmw X5 Bmw Cars

Pay Your Tax Now or You Will Be Barred From Travelling Oversea.

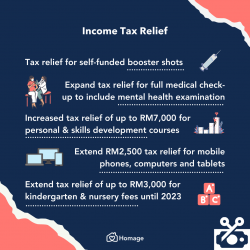

. Objective The objective of the. Special relief in addition to lifestyle relief for purchase of mobile phone personal computer or tablets for YA 2020 and YA 2021. Self and dependent relatives.

Now say the Government decides that all Residents of Malaysia should get a personal tax relief of up to RM9000 per year and the additional RM2000 for assesment year 2015 as previously mentioned. Self and DependentSpecial relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Medical treatment special needs and carer expenses for parents Medical condition certified by a usebenefit medical practitioner.

This additional relief is available for purchases made between 1 June 2020 and 31 December 2022 provided that the total amount claimed under. Appeal Against An Assessment And Application For Relief. JOINT MEMORANDUM ON ISSUES ARISING FROM 2017 BUDGET SPEECH FINANCE BILL 2016 Page 4 of 43 A.

As for insurance tax relief you can claim tax relief on the premiums paid subject to certain terms and conditions. Only fees for technical or management services rendered in Malaysia are liable to tax. 2017 Budget Speech Finance Bill 2016 1.

These are the types of personal reliefs you can claim for the Year of Assessment 2021. Special personal tax relief RM2000. As it was announced in Budget 2014 proposed in the latest Budget 2015 individuals income tax rates will be reduced by 1 to 3 with effective from the.

Personal Tax Reliefs in Malaysia. RM9000 in individual tax relief RM4620 in EPF contribution tax relief 11 of RM42000 which is RM4620 Putting both taxable. Increased to 28 wef YA 2016 25 for YA 2015.

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Highlights of 2016 Budget Increase in income tax reliefs Finance Bill 2015 Proposed new Subsection 461o to the Income Tax Act Parental care relief A tax relief of RM1500 for each. All income of persons other than a company co-operative or trust body.

Personal reliefs for resident individuals. Purchase of personal computer smartphone or tablet for self spouse or child and not for business use. The maximum tax relief amount.

For pensionable public servants they are entitled to a. 2500 Limited Lifestyle. For expatriates working for Labuan International there is a special rebate where foreign directors income is zero tax and.

62016 Date Of Publication. 72020 7102020 - Refer Year 2020. The YA 2016 for a company which closes its accounts on 30 June 2016 is the financial year ending 30 June 2016.

2018 Personal Tax Incentives Relief for Expatriate in Malaysia. S21 Wider Scope of the Term. Example 11 amended on 25092018 Superceded by the Public Ruling No.

Prime Minister Datuk Seri Najib Razak today announced a revised Budget 2016 Malaysia to optimise the countrys development and operational expenditures amidst falling oil. Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015. It is a combination of the tax relief for reading materials up to RM1000 a year computer up to RM3000 every three years and sports equipment up to RM300 a year.

INLAND REVENUE BOARD OF MALAYSIA GROUP RELIEF FOR COMPANIES Public Ruling No. 22 August 2016 Page 1 of 44 1. Your chargeable income will now be RM25000 RM36000-RM9000 RM2000.

Malaysia Personal Income Tax Rates 2013.

Green Cleaning Print Ads Green

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

Welcome To Livingactive Online Store Skin Protection Photo Aging Perfume Bottles

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Individual Income Tax In Malaysia For Expatriates

Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global

Malaysia Personal Income Tax Relief 2021

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

Malaysia Income Tax Guide 2016

Digital Postural Analysis App Software Accurate And Reliable Posture Assessment Evaluation And Analysis On Ipad Ip Workout Plan Template Assessment Analysis

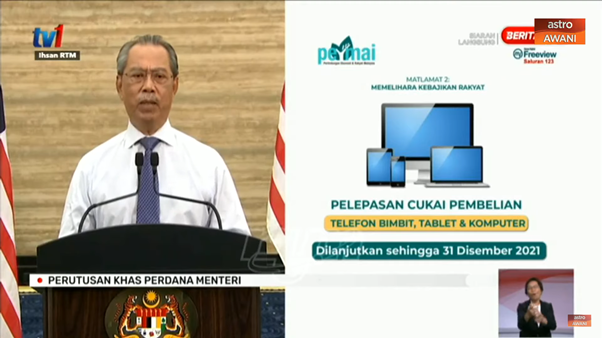

Govt Extends Tax Relief For Phones Computers Includes Covid 19 Tests For Medical Tax Relief

Pin On Ramadhan 2017 Allocation

Pin On Natural Home Remedies For Farts